Who invited the bear?

Rising costs, market selloffs, and a bear market upon us for this year's Fourth of July

Greetings people from space!

A few reminders before we jump in…

The opinions below are my lived space experience and therefore should not be taken seriously, as truth, or shared with meaningful conviction

Hit a paywall!? Ouch, try going incognito mode on your browser

Like or dislike something I said? Fantastic. Drop me a line!

🎙FIRESIDE CHAT

Howdy space people! With our annual celebration of tax evading aristocrats it’s time to fill up the cooler full of beer, light up the grill, and enjoy riveting conversation with your uncle on how much he had to pay to fill up his truck full of gas.

Nowadays it feels like you can’t go a day without talking about price hikes and the impending recession. It begs the question: what’s driving all of this doom and are we forever at the mercy of business cycles and market ‘corrections?’

You know the story, inflation is at a 40 year high, we’re experiencing the worst capital market since WWII, and the techno libertarian promises of cryptocurrencies have been disappointing to say the least. As JP Morgan CEO, Jamie Dimon, put it, ‘brace yourself’ there’s an ‘economic hurricane’ coming our way.

But let’s take a look at how we got here…

During the Great Depression a new school of thought led by economist John Maynard Keynes revolutionized how government and businesses addressed the economy in what came to be known as Keynseian economics. The theory went that when the economy slowed the government could restore full employment and price stability.

During “boom” cycles central banks could increase interest rates to generate more income from borrowers. During "bust" cycles central banks can lower interest rates, to increase spending. Sound familiar?

This policy helped fuel the American economy out of depression and toward the boom of the post-war era. So why has it been futile in its attempt to curb today’s rising inflation and market selloff? Well we have to fast forward past the British Invasion and Woodstock to the first wave of MAGA.

Profits, profits, and more profits!

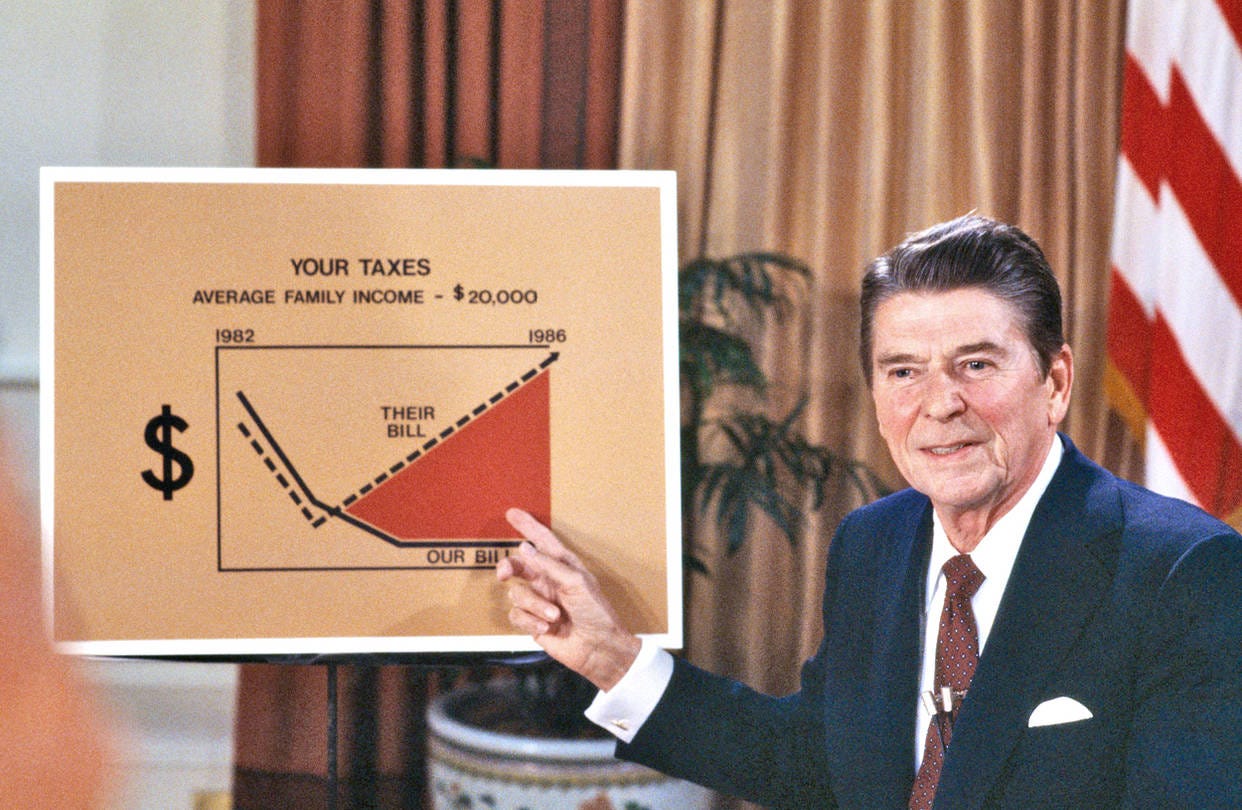

In the late 1970s economist Milton Friedman rebutted Keynes with his infamous doctrine in the New York Times. He argued that the supply of money in the economy rather than interest rates is what drives inflation. He also popularized the shareholder theory. That is, a corporation's greatest responsibility is to its shareholders not the society it operates within. And he has a perfect partner in Ronald Wilson Reagan.

[Insert 1980s corporate executive in tie standing over a boardroom shouting, ‘it’s in the shareholders interest!’]

Profits became the primary goal of business in the American economy. And as a result the societal goals that a business operates in soon became neglected. Hence rising inequality, pollution, and the decline of workers’ rights.

For the next few decades the American economy increasingly became a “winners take all” market, as top companies captured huge shares, leaving competitors in the dust.

The rich get richer

All of this exacerbated by globalization, tech booms in Silicon Valley, and “union avoidance” tilted power even further to corporations and those sitting at the top of the social hierarchy. The rich have been able to take advantage of a system designed for them to succeed at faster rates resulting in tremendous savings at the top.

Okay great, but why is that a problem? That’s capitalism, right? Well, let’s look at what happens when too much savings is incurred at one end of the society.

Savings is production minus consumption.

Let’s look at the classic example of a wheat farmer and his wheat.

A farmer produces 100 bushels of wheat. He gets hungry and decides to eat 10 bushels. But wheat rots and he can’t possibly eat the remaining 90 before they go bad, so he sells them off for some greenbacks. Those dollars are what we call his savings.

This is healthy and good when everyone is participating in this activity. But when huge parts of society save more than they spend, we get what’s called a “savings glut.”

Now let’s imagine that Farmer A has a less than fruitful harvest and therefore his income goes down and cannot spend as much. So he takes out a low interest loan to purchase bushels of wheat from Farmer B who had a good harvest.

Farmer B decides that he is having such a great year that he’s going to increase production by also taking advantage of the low interest loans to buy a tractor.

Next season Farmer B produces a lot more wheat and starts saving his profits. He cannot possibly spend all this money in the local economy and overtime starts to greatly outpace Farmer A.

Now of course I am oversimplifying this complex process and an economist of either camp would school me on my analogy. But the basic message is clear—monetary policy has major impacts on how people spend and save money.

There are consequences when too much money sits with the top 1% especially on a global scale. To combat this glut we must see production and thus banks react with offering more debt. So our central bank, the Fed, continues to keep interest rates low to encourage spending and production.

To the moon! Err… Mars?

As the Fed continues its policy of low interest rates to thwart recessions, costs of goods and services rise, and the rich get richer over time. The top 1% now make up almost half of all private savings and do not invest nearly enough back into our economy.

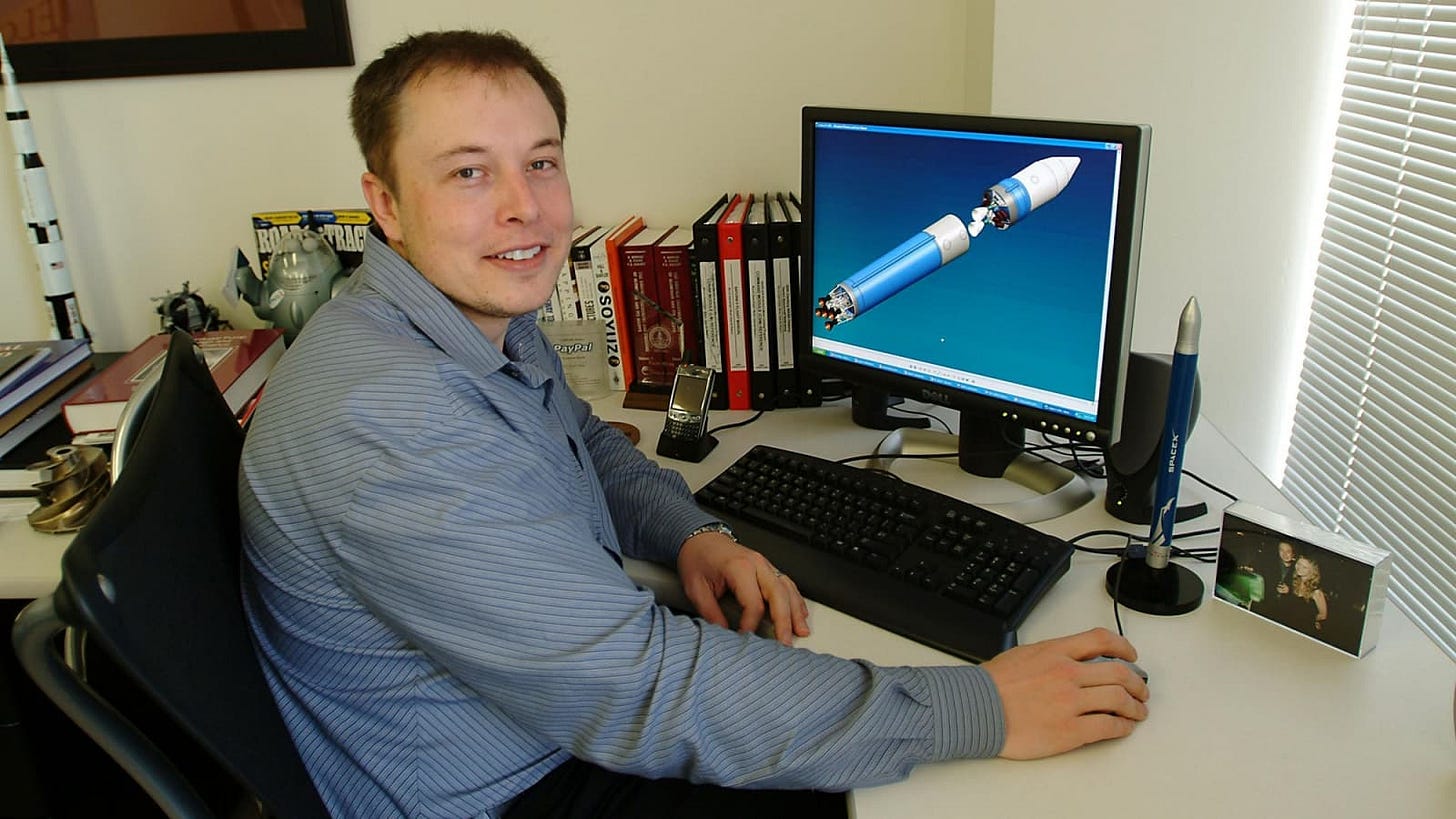

When large amounts of savings chase a limited number of assets, like stocks or real estate, prices go up. Who can afford such high costs!? Well, you guessed it, the rich benefit from that too. And thus the rich generate billions of dollars to experiment with trips to Mars and social media takeovers.

The Covid effect

Enter COVID-19, a global pandemic that caused economies to shut down, global supply-chains to be disrupted, a drop in production, and rising prices.

To encourage spending, central banks released more cash into the economy. Higher costs plus more spending equals inflation. Then uncertain and anxious markets led to even less production and the vicious cycle of continues.

The good, the bad, the ugly

Look, the past 50 years have not been all that bad. GDP per capita has surged since the 1960s. Personal consumption and life expectancy are both up, innovation has flourished, and society has enjoyed greater leisure time. The wealthy have not completely shied away from investment into innovation and philanthropic causes but they simply cannot spend fast enough to keep up with their growing new worth.

We have witnessed growing inequality with the decline of the middle class and the lower class stuck at the bottom. Technology has enabled companies to extract more from workers while paying them the same. Women still see 82 cents on the dollar and the racial wealth gap persists.

The bottom 90 percent are convinced to borrow more through low interest loans and easy access to credit. We take out mortgages on increasingly more expensive homes that simply cannot keep pace with rising costs. All while we save less and earn the same. It’s what the experts call unproductive debt.

I’m certainly not arguing that buying homes is bad, or that getting rich is bad. Both are great. In fact, they’re what keep me inspired to be part of the American Dream.

But perhaps it’s time for our governments to change policies directed at the top rather than for the rest of us. We could recognize that Jeff Bezos invests into Amazon, and therefore maybe taxing Amazon ain’t such a bad idea.

Legendary businessman and billionaire Ray Dalio put it quite bluntly when he stated “capitalism is not working well for the majority of American”. Profound words for the founder of the world's largest hedge fund.

Is economic growth still the goal? Or have social and global forces redefined the purpose of an economy and its corporations? In recent years the growing emphasis on the environment, social wellbeing, and corporate governance have forced us to revisit these existential questions.

Who knows the answer but what I will tell you is if we really want to create a “Great America” then perhaps it is time we focus on creating one a healthy, and balanced one that works for all Americans’ pocket books.

Happy Fourth of July 🇺🇸

🗞 THE NEWSSTAND

Zuckerberg gave a chilling warning to Meta employees as he forecast the dark economic times ahead.

Tesla, Netflix, Coinbase, Redfin and others announce deep job cuts as stock markets continue to slide.

Meanwhile, the company whose motto was once “Don’t be evil” has placed employee Blake Lemoine on leave for claiming that Google’s AI chat LaMDA has reached human-like emotions.

In crypto land massive sell offs drive bluechips BTC and ETH to 18 month lows, while the industry braces for impending regulatory changes following recent trade lockups.

And in my hometown of Akron, Ohio another young black man has been gunned by police after fleeing for a traffic infraction. He was shot 60 times and declared dead on the spot.

🎧 WEEKLY MIXTAPE

Getting her start producing beats for her father at age nine in Queens, New York, Yaya Bey, now based in Brooklyn, brings us storytelling R&B on her latest album Remember Your North Star. Her story is one of strong black womanhood, deeply inspired by the experiences around her.